SUPERCHARGE YOUR ONLINE VISIBILITY! CONTACT US AND LET’S ACHIEVE EXCELLENCE TOGETHER!

For years, SEO has been treated as a growth channel. Rankings went up, traffic followed, and revenue scaled alongside it. That mindset no longer reflects reality. Today, SEO is not just a lever for growth. It is a material business risk that can directly affect valuation, customer acquisition costs, and revenue stability.

This shift matters most for funded startups.

Once capital enters the picture, the pressure to grow quickly changes how SEO is executed. Content velocity increases. Automation and AI are introduced at scale. Technical changes happen faster than governance can keep up. What looks like momentum on the surface often hides structural weaknesses underneath. These weaknesses usually remain invisible until a core update, policy shift, or manual action exposes them.

Google’s algorithm updates are no longer minor fluctuations. They can erase years of organic growth in weeks. For a funded company, that loss does not just mean fewer visitors. It means sudden CAC inflation, broken revenue forecasts, missed board targets, and in some cases delayed fundraising or failed acquisitions. Organic traffic has become a valuation input, and unstable organic traffic is a risk signal.

This is why SEO risk audits are increasingly showing up in serious due diligence conversations. Investors are no longer satisfied with traffic charts and keyword reports. They want to understand how fragile that growth is, how dependent it is on a narrow set of tactics, and how exposed the company is to algorithmic change.

The core takeaway is simple but uncomfortable. If SEO drives acquisition, SEO risk drives downside. Ignoring that risk does not make it disappear. It only delays the moment when it becomes expensive.

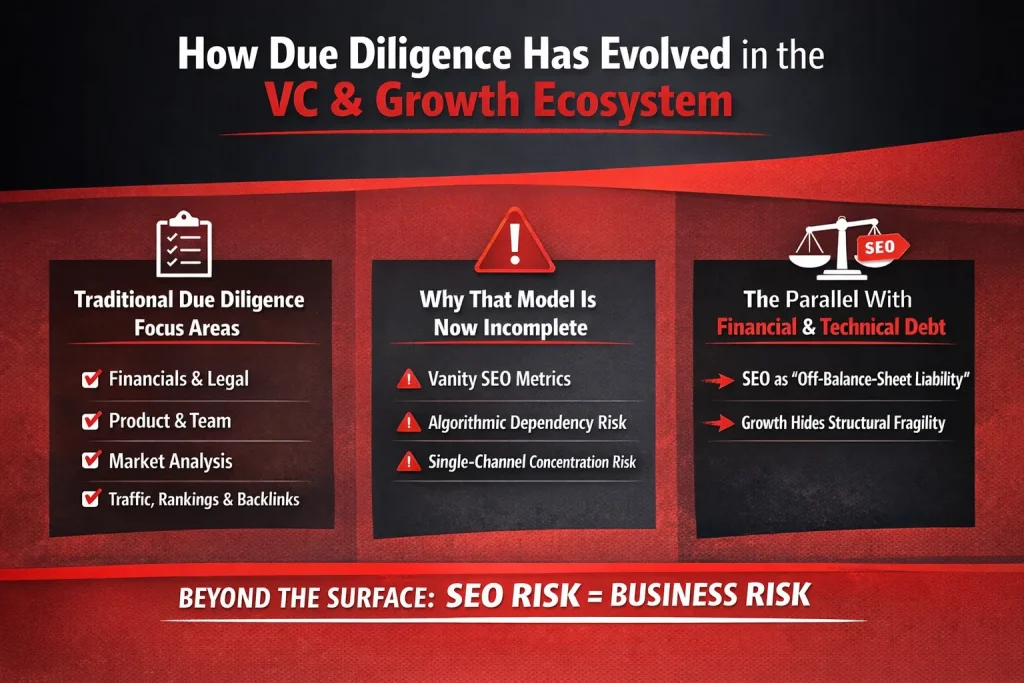

How Due Diligence Has Evolved in the VC and Growth Ecosystem

For years, due diligence followed a familiar checklist. Investors scrutinized financial statements, legal structures, product defensibility, leadership teams, and market size. When marketing entered the conversation, it usually stayed at a surface level. Teams looked at traffic growth charts, keyword rankings, backlink counts, and sometimes brand search trends. If organic traffic was growing, SEO was considered “healthy” and the box was checked.

That approach worked when search engines were more forgiving and growth cycles were slower. It no longer reflects how modern organic acquisition actually behaves.

Why the Old Model No Longer Holds Up

Today, relying on high-level SEO metrics is risky. Traffic and rankings tell you what is happening, not why it is happening or how fragile it might be. Many funded startups show impressive organic growth while sitting on structural risks that only reveal themselves after a major algorithm update or policy shift.

One of the biggest blind spots is algorithmic dependency. When a large portion of revenue or pipeline depends on organic search, the business is exposed to changes it does not control. Google updates now regularly reshape entire categories overnight. A growth chart that looks stable today can become a liability tomorrow if the underlying signals are weak or misaligned with long-term search quality standards.

There is also the issue of channel concentration. In many venture-backed companies, SEO quietly becomes the dominant acquisition engine. That concentration rarely shows up in traditional diligence frameworks, yet it carries the same risk profile as relying on a single enterprise customer or one paid channel.

SEO Risk and the Debt Parallel

This is where SEO risk starts to resemble financial or technical debt. It often stays off the balance sheet. Growth masks it. As long as traffic rises, nobody asks hard questions. But just like fragile infrastructure or aggressive accounting assumptions, the cost shows up eventually.

When it does, the impact is not limited to traffic loss. It affects CAC, revenue predictability, investor confidence, and exit readiness. Modern due diligence is beginning to reflect this reality. SEO is no longer just a growth lever. It is a risk surface that deserves the same scrutiny as finance, technology, and operations.

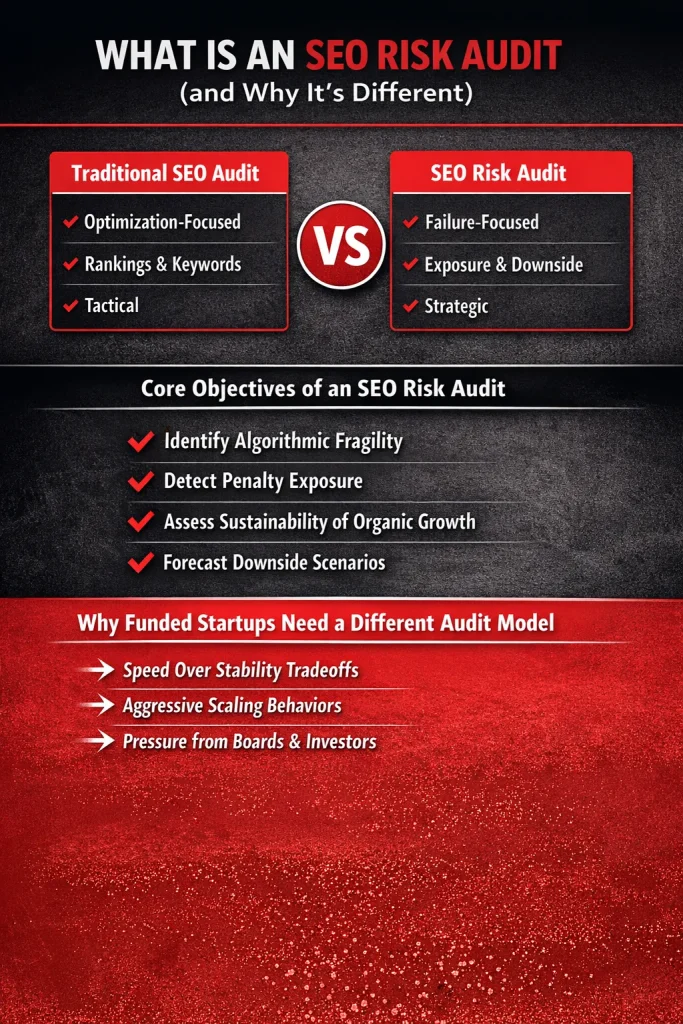

What Is an SEO Risk Audit and Why It Is Different

Most founders and growth leaders are familiar with a traditional SEO audit. It usually focuses on rankings, keywords, technical fixes, and quick optimization wins. That approach works when the goal is incremental improvement. It breaks down when SEO becomes a major revenue driver and a potential liability.

An SEO risk audit looks at the same ecosystem from a very different angle. Instead of asking, “How can we rank higher?” it asks, “What could realistically go wrong, and how bad would the impact be if it did?”

SEO Audit vs SEO Risk Audit

A traditional SEO audit is optimization-focused. It evaluates keyword coverage, on-page gaps, backlink counts, and technical hygiene with the goal of improving performance. The mindset is tactical and short-term. Fix issues, unlock growth, move faster.

An SEO risk audit is failure-focused by design. It examines exposure rather than opportunity. Rankings and traffic still matter, but only as inputs to assess downside. The emphasis shifts to questions like how dependent growth is on a narrow set of pages, how resilient content is to algorithm updates, and how much organic revenue could disappear under adverse conditions. This makes it a strategic exercise rather than a checklist.

Core Objectives of an SEO Risk Audit

At its core, an SEO risk audit aims to surface weaknesses before they turn into real losses. It identifies algorithmic fragility by analyzing volatility patterns and dependency on specific ranking signals. It detects penalty exposure, including subtle spam or quality signals that rarely show up in standard audits. It also evaluates whether organic growth is sustainable or inflated by tactics that will not age well. Most importantly, it models downside scenarios so leadership can understand what a 20 percent or 40 percent traffic drop would mean for revenue, CAC, and runway.

Why Funded Startups Need a Different Audit Model

Funded startups operate under conditions that amplify SEO risk. Speed often wins over stability, especially after a funding round. Content scales aggressively, automation is introduced quickly, and guardrails are added later if at all. At the same time, founders face pressure from boards and investors to show predictable growth. A standard SEO audit does not account for these realities. A risk-focused audit does. It aligns SEO evaluation with how funded companies actually grow, fail, and are judged.

Why Funded Startups Are Uniquely Exposed to SEO Risk

For many startups, funding is the moment when everything accelerates. Headcount grows, content production ramps up, tools are added, and growth expectations rise sharply. This is also the point where SEO risk quietly compounds, often without anyone noticing until traffic or revenue drops.

The Post-Funding Growth Trap

After a funding round, speed becomes the priority. Content teams are asked to publish faster, cover more keywords, and outpace competitors. What starts as a reasonable SEO strategy often turns into a content velocity explosion. Blogs, landing pages, integrations, and programmatic pages go live at scale, but quality control struggles to keep up.

Programmatic SEO is a common casualty here. It is powerful when carefully designed, but many funded startups treat it as a shortcut. Thousands of near-identical pages get generated with thin differentiation, weak intent matching, or little real value for users. These pages may rank briefly, which creates false confidence, but they also increase exposure to quality-based algorithm updates.

Automation adds another layer of risk. Tools for keyword clustering, internal linking, content generation, and publishing are deployed quickly. Without clear governance, automation starts making decisions that were once handled by experienced SEO strategists. Over time, this creates patterns that search engines recognize as manipulation rather than optimization.

Organizational Risk Factors

Funding also changes how SEO fits into the organization. In many startups, SEO remains outsourced or partially managed by agencies that are measured on growth metrics, not long-term risk. When something breaks, there is often no internal owner accountable for organic stability.

At the same time, product and engineering teams move fast. Site migrations, design changes, CMS updates, and JavaScript frameworks are introduced to support growth or branding goals. SEO safeguards are rarely part of these decisions. Small technical changes can quietly affect crawlability, indexation, or internal linking at scale.

AI-driven content adds further complexity. Many funded teams push AI-assisted content live to meet aggressive targets, but few have strong editorial or review frameworks in place. Over time, this can dilute topical authority, blur brand voice, and weaken trust signals that search engines increasingly value.

Capital Amplifies Mistakes

Capital does not just accelerate growth. It amplifies mistakes. When a bootstrapped company makes an SEO error, the impact is often limited by scale. A funded startup operates at a much larger footprint. The same mistake now affects thousands of pages, multiple markets, and a significant share of revenue.

Penalties and algorithm hits are also harder to absorb. Funded companies rely on predictable growth to justify valuation and future rounds. A sudden drop in organic traffic can inflate acquisition costs overnight and disrupt board-level forecasts. What looks like an SEO issue quickly becomes a business risk.

This is why funded startups face a different SEO reality. Their speed, scale, and pressure to perform create conditions where risk grows faster than reward unless it is actively managed.

The Hidden SEO Risks Investors Rarely See

Most investors reviewing a startup’s SEO only see surface indicators: traffic curves, keyword counts, and month-over-month growth. What rarely shows up in a data room are the structural weaknesses underneath that growth. These blind spots matter because they determine whether organic revenue is durable or one algorithm change away from collapse.

Algorithm Dependency Risk

Many funded startups unknowingly build their growth on a narrow set of ranking signals. When a single Google update can materially change revenue, the business carries hidden concentration risk. Core updates tend to rebalance authority, trust, and relevance across an entire market. Helpful Content updates, on the other hand, are more surgical. They target sites that scale content faster than expertise.

Investors often misread steady traffic as stability. In reality, a site that relies on one content format, one keyword cluster, or one interpretation of “helpfulness” can lose demand overnight. This type of dependency rarely appears in dashboards, yet it directly affects forecast reliability.

Technical Architecture Risks

Modern startup stacks are powerful but fragile. JavaScript-heavy frameworks can quietly block search engines from seeing critical pages, even while users have a smooth experience. Headless CMS setups introduce another layer of risk when rendering, routing, or internal linking logic changes without SEO oversight.

Crawl budget issues are even harder to spot. Large sites with faceted navigation, programmatic pages, or rapid releases can waste crawl resources on low-value URLs. When that happens, important pages lose visibility long before rankings drop. From an investor perspective, this is technical debt disguised as innovation.

Content and Authority Risks

AI-assisted content has made publishing easier, but it has also diluted authority across many funded startups. When hundreds of pages are produced without a clear editorial standard, topical depth erodes. The site appears broad but not credible.

Link profiles can suffer similar decay. Legacy links from past agencies, low-quality partnerships, or expired campaigns often linger unnoticed. Over time, this contamination weakens trust signals and increases volatility during algorithm updates. Authority is cumulative, but so is damage.

Compliance and Policy Risks

Some SEO risks are not algorithmic at all. They are compliance-related. Spam signals can accumulate from scaled templates, repetitive structures, or thin variations that technically index but fail policy thresholds.

Scaled content abuse is especially common after funding, when teams chase speed. Parasite SEO, intentional or inherited through partnerships, adds another layer of exposure. These issues rarely trigger immediate penalties, which is why they are overlooked. When enforcement does happen, recovery is slow and expensive.

For investors, these hidden risks explain why SEO performance should be evaluated as infrastructure, not marketing output. Growth tells you where a company is today. Risk tells you whether it can stay there.

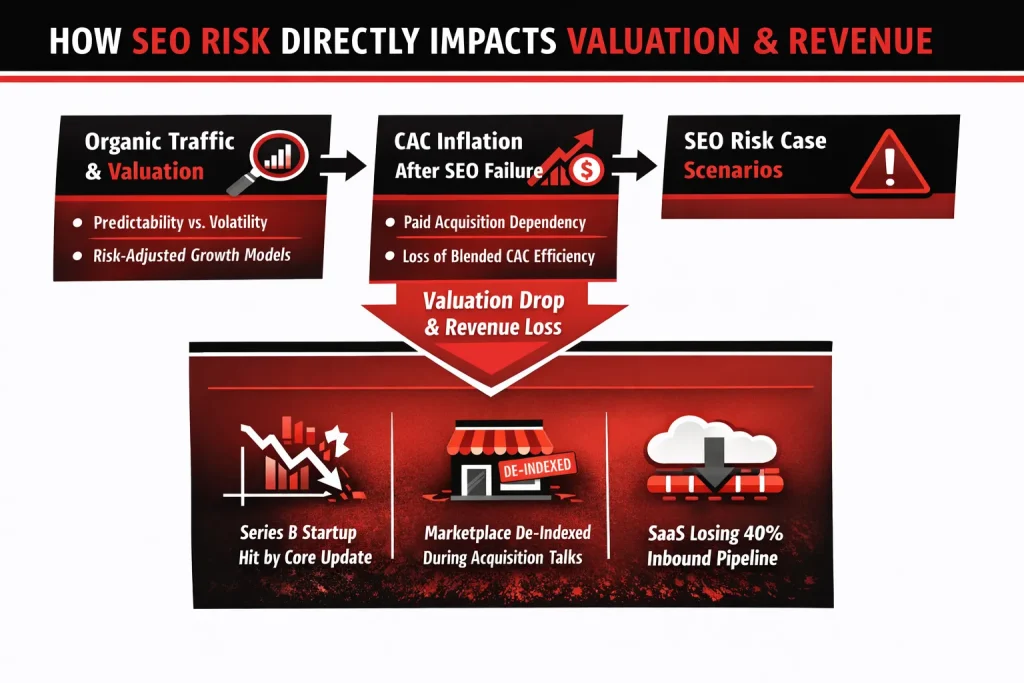

How SEO Risk Directly Impacts Valuation and Revenue

For funded startups, SEO is no longer just a marketing channel. It has become a financial variable that directly affects valuation, revenue stability, and investor confidence. When organic growth is strong and consistent, it quietly boosts perceived company health. When that growth is fragile or volatile, it introduces risk that shows up quickly in boardrooms and term sheets.

Organic Traffic as a Valuation Multiple

Organic traffic is often treated as a proxy for brand strength and market demand. Predictable, steadily growing organic traffic signals that customer acquisition costs are under control and that demand exists even without heavy paid spend. This kind of consistency makes revenue forecasts more reliable, which investors reward with higher valuation multiples.

The problem starts when organic growth is volatile. If traffic spikes are driven by aggressive tactics, thin content, or overreliance on a narrow set of keywords, the growth is not durable. Sophisticated investors increasingly look beyond topline traffic numbers and ask how resilient that traffic is to algorithm updates. In risk adjusted growth models, unstable SEO performance leads to discounted future revenue projections, even if current numbers look impressive.

In simple terms, predictable SEO growth compounds valuation, while fragile SEO growth quietly erodes it.

CAC Inflation After SEO Failure

When SEO fails, the financial impact is immediate. The most common response is to compensate with paid acquisition. This creates a sudden dependency on ads to fill pipeline gaps that organic traffic once covered.

As paid spend increases, blended CAC rises. Channels that were once profitable at scale begin to struggle. Teams often justify this as a temporary fix, but in reality, many companies never fully recover their previous efficiency. The loss of organic acquisition forces hard tradeoffs between growth and margin, especially in competitive markets where paid costs are already high.

What makes this more dangerous is timing. SEO failures rarely happen during slow periods. They tend to hit when growth expectations are highest, which amplifies financial pressure.

Case Scenarios That Play Out Every Year

Consider a Series B startup that built its inbound engine on high velocity content. A core update rolls out, and within weeks, organic traffic drops by 30 percent. The product is solid, but pipeline projections are suddenly missed, forcing emergency budget reallocations.

In another case, a marketplace preparing for acquisition faces partial de-indexation due to technical and content quality issues. The deal does not collapse, but valuation is renegotiated after traffic risk is uncovered.

Or take a SaaS company that wakes up to a 40 percent overnight drop in inbound leads. No penalty notification appears. The damage comes from accumulated SEO risk that finally catches up.

These scenarios are not edge cases. They are the financial cost of ignoring SEO risk.

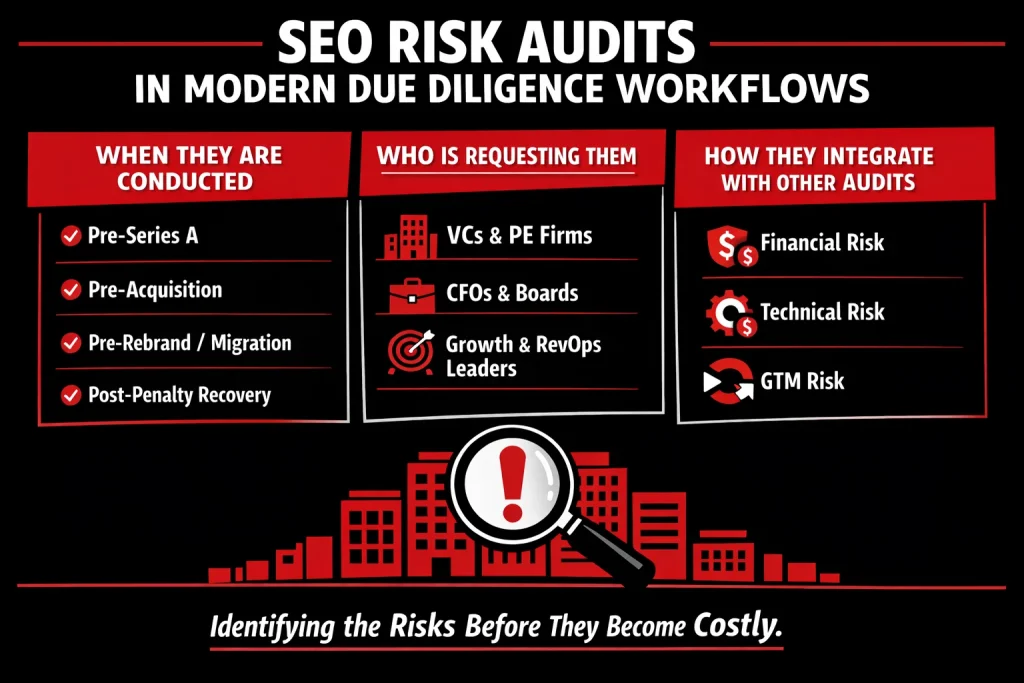

SEO Risk Audits in Modern Due Diligence Workflows

SEO risk audits have quietly moved from being a “nice-to-have” review to a practical checkpoint in modern due diligence. This shift is not driven by theory or trends, but by repeated real-world losses where organic growth collapsed after funding, acquisitions, or major platform changes. Today, companies that rely on search as a growth channel are learning that SEO risk must be assessed at the same time as financial and technical exposure.

When SEO Risk Audits Are Being Conducted

SEO risk audits are most often introduced at moments where decisions are expensive to reverse.

Before a Series A round, founders and early investors want to confirm that early traction is not built on fragile tactics that could break once the company scales. A sudden drop in organic acquisition after funding can stall momentum and force unplanned spending on paid channels.

Before acquisitions, SEO risk audits help buyers understand whether organic traffic is durable or artificially inflated. In several deals, search-related risks have led to price renegotiations or delayed closings once hidden dependencies were uncovered.

During rebrands or platform migrations, SEO risk audits act as a safety net. Domain changes, CMS migrations, and URL restructuring often introduce crawl and indexation risks that are hard to detect after launch.

Post-penalty recovery audits are usually reactive but critical. At this stage, the focus shifts from growth to survival, identifying what caused the penalty and whether recovery is realistic within business timelines.

Who Is Requesting Them

The demand rarely comes from SEO teams alone. Venture capital and private equity firms increasingly request SEO risk assessments to protect portfolio value. CFOs and board members ask for them when organic traffic influences revenue forecasting. Growth and RevOps leaders rely on these audits to validate whether inbound pipelines are stable enough to support scaling targets.

How They Integrate With Other Audits

SEO risk audits work best when paired with broader due diligence. Financial audits highlight revenue concentration risk, while SEO audits explain how fragile that revenue might be. Technical audits examine infrastructure, and SEO audits reveal how search engines actually experience it. Go-to-market audits focus on acquisition strategy, and SEO risk audits assess whether organic demand can reliably support that strategy over time.

Together, they provide a clearer picture of operational resilience rather than surface-level performance.

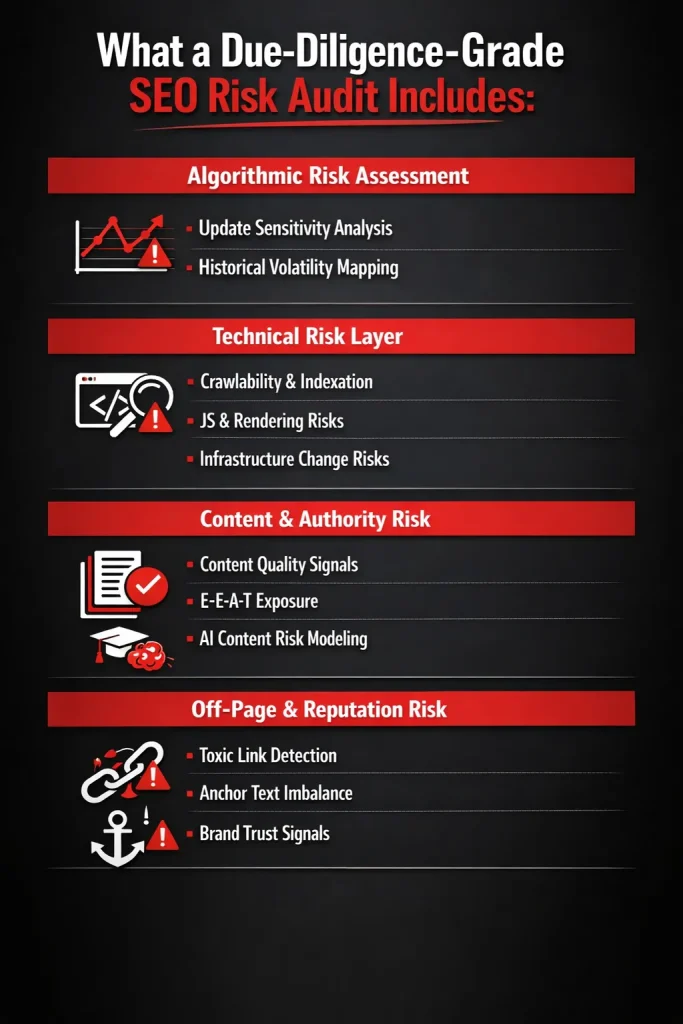

What a Due-Diligence-Grade SEO Risk Audit Includes

A due-diligence-grade SEO risk audit goes far beyond checking rankings, traffic graphs, or keyword positions. Its purpose is not to show how well a site is performing today, but how exposed it is to failure tomorrow. For funded startups, this distinction matters because organic growth is often deeply tied to revenue forecasts, investor confidence, and valuation assumptions.

Below is what separates a serious SEO risk audit from a surface-level review.

Algorithmic Risk Assessment

The first layer examines how dependent a company’s growth is on Google’s changing algorithms. Update sensitivity analysis looks at how the site has reacted to past core updates, helpful content updates, and spam updates. If traffic spikes or crashes align closely with algorithm changes, that is a signal of fragility rather than strength.

Historical volatility mapping adds context by tracking performance stability over time. A startup with steady, incremental growth across multiple updates is far less risky than one showing sharp swings. Investors care about predictability, and this analysis helps reveal whether organic traffic behaves like a stable asset or a speculative one.

Technical Risk Layer

Technical SEO risk is often invisible until it causes damage. Crawlability and indexation analysis checks whether search engines can consistently access and understand the site at scale. Problems such as orphaned pages, bloated parameter URLs, or misconfigured noindex rules frequently appear after rapid growth or platform changes.

JavaScript and rendering risks are especially relevant for modern, product-led startups. Heavy client-side rendering, delayed content loading, or incomplete server-side rendering can prevent critical pages from being indexed correctly. Infrastructure change risks assess how deployments, migrations, or CMS updates could unintentionally disrupt search visibility, a common issue in fast-moving engineering teams.

Content and Authority Risk

Content risk is no longer about volume. A due-diligence audit evaluates content quality signals across the site, including duplication, thin pages, and misaligned search intent. It also looks at topical coherence. Scaling content without a clear authority framework often leads to dilution rather than dominance.

E-E-A-T exposure is assessed by reviewing author credibility, brand expertise signals, and trust elements across content. AI content risk modeling has become essential as startups adopt generative tools. The audit examines how AI is used, where human oversight exists, and whether automation has introduced patterns that could trigger quality or spam concerns.

Off-Page and Reputation Risk

Off-page risk focuses on how the site is perceived outside its own domain. Toxic link detection identifies backlinks that may attract algorithmic penalties or manual actions. Anchor text imbalance analysis highlights over-optimization that often comes from aggressive link building or legacy SEO campaigns.

Finally, brand trust signals are reviewed across search results, citations, and mentions. Weak or inconsistent brand signals can amplify the impact of any negative update. For funded companies, this layer connects SEO risk directly to reputation risk, making it highly relevant to both founders and investors.

Taken together, these layers create a realistic picture of downside exposure, not just upside potential.

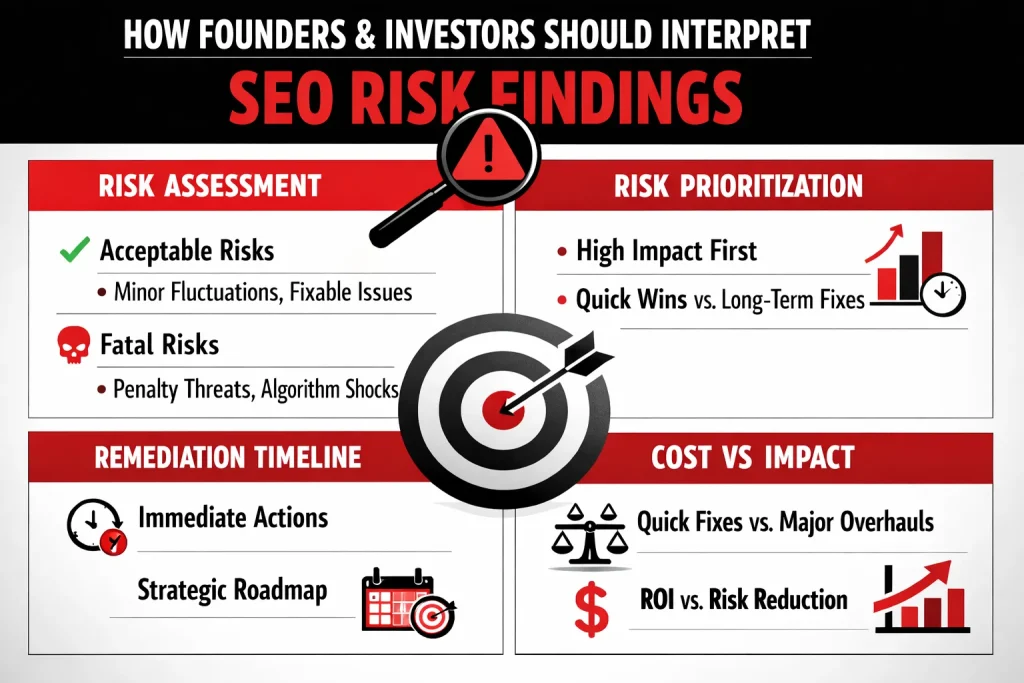

How Founders and Investors Should Interpret SEO Risk Findings

An SEO risk audit is only valuable if the findings lead to clear decisions. For founders and investors, the goal is not to eliminate every risk, but to understand which risks are manageable and which ones threaten the business at a structural level.

Start by separating acceptable risks from fatal ones. Acceptable risks are usually tactical or reversible, such as thin content clusters, weak internal linking, or minor technical inefficiencies. These issues rarely threaten revenue overnight and can be fixed without disrupting growth. Fatal risks are different. These include dependency on manipulative link building, large-scale AI content with no editorial control, widespread indexation problems, or a history of penalties that were never properly resolved. These risks can wipe out organic acquisition suddenly and without warning.

Once risks are classified, prioritization becomes essential. A useful framework is to score each issue based on two factors: likelihood and impact. Ask simple questions. How likely is this issue to trigger an algorithmic hit or manual action? If it does, how much revenue, pipeline, or valuation is exposed? High-likelihood and high-impact risks should always move to the top of the remediation list, even if they are uncomfortable or expensive to fix.

Timelines matter as much as severity. Some risks can be addressed within weeks, such as technical fixes or content pruning. Others, like rebuilding topical authority or cleaning a toxic link profile, may take six to twelve months. Founders should align remediation timelines with funding milestones, board expectations, and growth forecasts.

Finally, evaluate cost versus impact honestly. A six-figure remediation effort may seem expensive, but it is often trivial compared to the cost of lost organic revenue, inflated CAC, or a reduced exit multiple. Interpreting SEO risk correctly turns it from a vague marketing concern into a disciplined business decision.

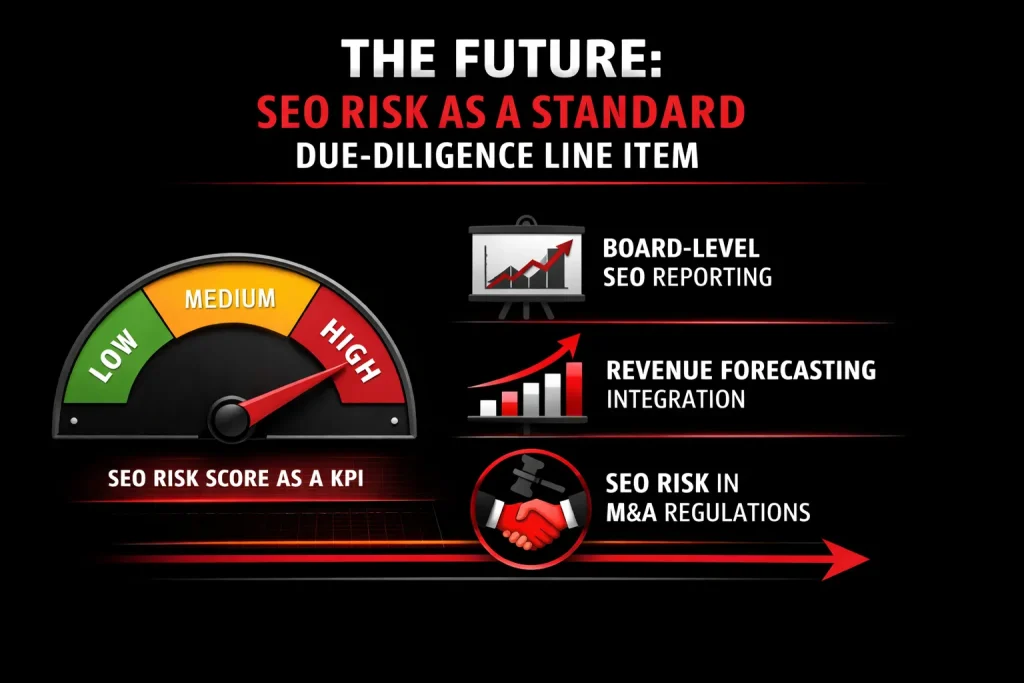

The Future: SEO Risk as a Standard Due-Diligence Line Item

SEO is quietly moving into the same category as finance, legal, and technical audits in modern due diligence. Not because search rankings are trendy, but because organic traffic has become a material business asset. When a large share of pipeline, revenue, or customer acquisition depends on search, the risks attached to it can no longer live in marketing dashboards alone.

One of the biggest shifts ahead is the emergence of SEO risk scoring as a KPI. Similar to credit risk or technical debt scores, this metric helps investors and leadership teams understand how fragile or resilient organic growth really is. It goes beyond traffic numbers and looks at volatility exposure, dependency on specific algorithms, content quality signals, and technical architecture. For growth-stage companies, this score increasingly influences how confidently future revenue can be projected.

As a result, SEO is also moving into the boardroom. Board-level SEO reporting is becoming less about keyword wins and more about risk posture. Questions are changing. How exposed are we to a core update. What percentage of revenue depends on pages that could lose visibility overnight. What would recovery realistically cost in time and cash. These are governance questions, not marketing ones.

Another important evolution is the integration of SEO risk into revenue forecasting. Forward-looking models are beginning to factor in downside scenarios tied to algorithm changes, site migrations, or content scale decisions. This makes forecasts more honest and reduces unpleasant surprises.

Looking ahead, SEO risk is likely to become a regulated consideration in M&A. As acquisitions rely heavily on digital performance, undisclosed organic traffic risk will increasingly be treated as a material omission. In that future, SEO risk audits will not be optional. They will be expected.

Conclusion: SEO Risk Is Now Business Risk

For a long time, SEO was treated as a growth lever. Something to accelerate traffic, reduce CAC, and show momentum to investors. That mindset no longer holds up. For funded startups, organic search has quietly become a core business dependency, and with that dependency comes risk.

What we have seen across growth-stage companies is a clear pattern. Rapid scaling introduces technical shortcuts, aggressive content production, and automation-heavy decisions that look efficient in the short term but weaken long-term stability. When a core update, manual action, or indexing issue hits, the impact is not limited to rankings. It shows up in pipeline volatility, missed forecasts, inflated paid spend, and uncomfortable board conversations.

This is why SEO risk audits are moving into the due-diligence conversation. Not as a marketing exercise, but as a way to understand downside exposure. Founders, investors, and operators who still view SEO only through a growth lens are underestimating its influence on valuation and resilience.

The real shift is simple but critical. The goal is no longer just faster growth. It is durable growth that can withstand change. In today’s search environment, resilience is the competitive advantage.