SUPERCHARGE YOUR Online VISIBILITY! CONTACT US AND LET’S ACHIEVE EXCELLENCE TOGETHER!

The marketing landscape has changed so quickly that many leadership teams have not yet caught up. What used to be a predictable system built on search traffic and lead volume has been replaced by something far more fluid. Customers are no longer starting their journey with a keyword typed into a search bar. They are beginning inside AI-generated answers, conversational interfaces, and blended search environments that rely on context rather than links. As a result, the role of the CMO looks very different today. The CMO now influences how a company appears, is interpreted, and is recommended across a growing mix of intelligent systems. This makes the CMO the natural center of alignment for Sales, Product, and Finance because each of these groups depends on the company’s presence inside this new customer reality.

This shift has serious financial consequences. Companies are losing opportunities not because of weak products or a lack of demand, but because their internal teams are operating from different assumptions. Sales often feels pressure to hit numbers without a reliable flow of qualified demand. Product teams make decisions based on incomplete signals about how buyers talk and what they expect. Finance tries to plan budgets using marketing data that no longer reflects where buyers begin or how they evaluate options. When these gaps widen, organizations lose millions in preventable revenue leakage. The root issue is misalignment, and the emerging digital environment is exposing it more clearly than ever.

At the same time, traditional search as leaders know it is becoming a smaller part of the buyer journey. What now shapes demand is the reality that AI systems construct around brands. Visibility inside this environment is not earned through keywords alone. It is earned through structured understanding, entities, relationships, authority, and consistency across every point where a model draws an answer. CMOs who understand how to shape this reality gain a level of strategic leverage that their competitors will struggle to match.

This is where the concept of Reality Optimization becomes essential. It provides a way for CMOs to bring Sales, Product, and Finance into a single operating rhythm. Instead of separate teams pulling from scattered data, they can work from one shared view of the market. ThatWare’s Cognitive Web program supports this alignment. It begins with a Reality Audit that shows where the brand stands today. It then moves into an architectural phase that builds the foundations needed to influence AI and search ecosystems. Finally, it shifts into a long-term stage that establishes dominance and internal adoption.

The result is a unified growth system that allows CMOs to guide the entire organization with clarity, reduce internal friction, and create measurable impact in a digital environment that is evolving faster than ever.

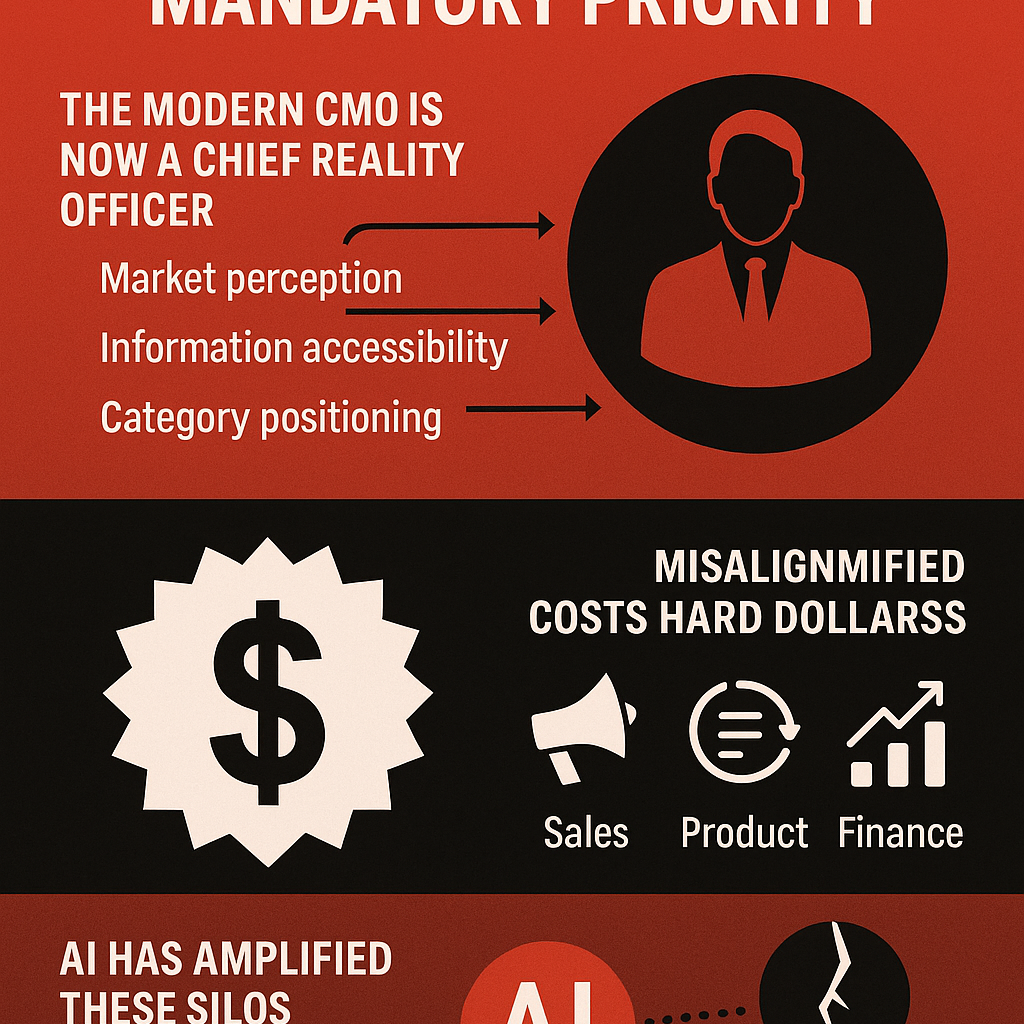

Why C-Suite Alignment Has Become the CMO’s New Mandatory Priority

There was a time when marketing leaders could focus on brand, campaigns, and top-of-funnel success and still be celebrated. That era is gone. Today’s CMO is expected to influence revenue, forecast market shifts, shape product narratives, and even steer financial conversations. This shift didn’t happen overnight. It emerged from a fundamental change in how buyers learn, evaluate, and decide.

Modern buyers no longer begin their journey with a website visit or a search query. They start with an AI answer. Whether it’s a quick question inside ChatGPT, a voice-based prompt, or a summary delivered by Gemini or Perplexity, buyers receive a distilled version of “reality” created by the digital ecosystem. This means the CMO is no longer just a storyteller. The CMO is the person responsible for how the brand appears, behaves, and competes across these AI-driven environments.

This new reality forces CMOs to act almost like a Chief Reality Officer, someone who owns three core responsibilities that directly influence every department:

- Market Perception:

Buyers trust what AI engines show them. If your brand is absent from those answers or framed incorrectly, it shapes how prospects perceive your entire category. CMOs must safeguard this perception.

- Information Accessibility:

AI tools pull data from structured signals, entity relationships, and content frameworks. If the information is buried or poorly structured, the brand loses visibility, and Sales suffers downstream.

- Category Positioning Across AI Engines:

CMOs must guide how their company shows up across AI systems, not just traditional search. This affects messaging, product communication, pricing narratives, and competitive comparisons.

Because these responsibilities influence the full customer lifecycle, they naturally overlap with Sales, Product, and Finance. Alignment isn’t optional. It is the only way to maintain a consistent and credible market presence.

Misalignment Is Not Just an Internal Problem. It Is a Financial One.

Every leader talks about alignment, but few quantify the cost of not having it. When Sales, Product, and Finance run on different assumptions, the entire growth engine starts to stutter.

Sales teams lose revenue because the content and messaging they rely on do not match the actual intent of the market. They face objections they weren’t prepared for, or they chase accounts that have no real need. Marketing may be producing content, but if it doesn’t reflect the questions buyers ask inside AI systems, it doesn’t generate qualified demand.

Product teams risk building the wrong features because they lack visibility into emerging search patterns, new customer motivations, or shifting competitive narratives. Without real-time market intelligence, the product roadmap becomes reactive instead of strategic. This leads to adoption issues, weak product-market fit, and launches that fail to gain traction.

Finance suffers as well. When ROI is measured with outdated metrics, budget planning becomes guesswork. If Finance cannot connect marketing influence to pipeline or revenue, they cut budgets or shift funds to areas with clearer value paths. This reduces the marketing team’s ability to experiment or innovate.

Studies show that even a modest misalignment can have outsized consequences. A gap of only ten to fifteen percent between Sales and Marketing often results in a revenue reduction of twenty to twenty-five percent across the year. That number is not theoretical. It plays out in missed targets, lost deals, and increased customer churn.

In other words, misalignment has a price tag. And it is far higher than most organizations realize.

AI Has Quietly Deepened the Silos Inside Companies

AI has reshaped the buyer journey so quickly that most organizations haven’t caught up. While teams still follow a traditional funnel, customers navigate in a completely different way.

Search is no longer a step-by-step path. It’s fluid. People ask a question, receive an answer, refine it, ask again, compare alternatives, and make a decision before ever visiting a website. AI collapses the entire funnel into a single interaction. That means Sales, Product, and Finance cannot rely on old models to understand buyer intent, demand forecasts, or category changes.

What typically happens inside organizations is that each department reacts in isolation:

- Marketing tries to optimize content the way it always has.

- Sales adjusts messaging based on anecdotal feedback from calls.

- Product focuses on feature requests instead of market intelligence.

- Finance allocates budgets based on lagging indicators.

None of these responses reflect how AI systems reshape demand. Without a unified understanding of how customers see the brand inside these new environments, departments end up pulling in different directions.

For CMOs, this creates a new kind of pressure. They are the only leaders who can bridge the gap between market reality and internal execution. CMOs now sit at the intersection of customer insight, product strategy, revenue forecasting, and financial modeling. Their decisions touch every part of the growth machine.

This is why C-Suite alignment is no longer a leadership preference. It is a strategic requirement. CMOs who embrace this responsibility not only strengthen their organization’s internal cohesion, they also protect and expand their brand’s position in an increasingly AI-controlled marketplace.

Why Traditional SEO Agencies Cannot Solve This

Most executives already feel this in their gut, even if they cannot always articulate it: the old model of SEO simply does not match the way people discover, evaluate, and trust information anymore. Search behavior has changed. The digital environment has changed. Algorithms have changed. What has not changed is the playbook that many SEO agencies still cling to. That disconnect is the reason companies outgrow these vendors and start looking for something deeper, more strategic, and more aligned with how business decisions actually happen.

SEO Is Dead in the Way Executives Understand It

For years, SEO meant a predictable mix of rankings, keywords, and link-building. It was a technical service. A production line. You fed it content and backlinks, and eventually your pages climbed higher. That world is disappearing.

Modern discovery does not start with a keyword typed into a search box. People ask questions to AI systems. They expect an immediate answer. They compare brands based on how visible they are inside these new answer engines. They rely on entities, not keywords. They search through voice prompts, product feeds, and AI summaries. The center of gravity has moved from “How do I rank on page one” to “How do I become the default answer in every AI system.”

Executives already see the symptoms. Competitors that used to be invisible suddenly dominate category answers in ChatGPT, Gemini, and Perplexity. Entire intent clusters vanish from traditional SERPs. Content that once held strong positions no longer shows up when an AI engine summarizes the topic. These are not algorithm updates. This is a shift in how reality itself is constructed online. Traditional SEO simply has no place in this new environment.

High-Ticket Buyers Want Strategic Partners, Not Tactic Vendors

When CMOs evaluate partners today, they are not asking how many backlinks an agency can build or how many blog posts the team can pump out each month. They want something entirely different. They want help navigating organizational alignment. They want intelligence, not dashboards. They want clarity about risks emerging from AI ecosystems. They want to understand how their brand will capture revenue and market share in an environment where AI engines increasingly act as the primary point of influence.

Traffic growth is not impressive to a CMO sitting in front of a board. Revenue influence is. Pipeline movement is. Predictive intelligence is. High-ticket buyers in enterprise environments also want partners who understand how Sales, Product, and Finance intertwine with digital visibility. They want someone capable of speaking the language of risk, forecasting, and executive decision-making. This is the gap that most SEO agencies cannot even see, let alone fill.

Why ThatWare Is Not an SEO Agency

This is where ThatWare separates itself completely. The company is not built around keyword checklists or technical audits. It operates on a much higher plane, closer to digital transformation than marketing services.

Reality Optimization sits at the center of ThatWare’s work. Instead of asking how to rank a page, the team maps the full knowledge environment surrounding a brand. The KGX architecture becomes the structural backbone, giving organizations a living, breathing knowledge graph that influences how AI systems interpret them. GEO and PromptRank guide how the brand appears in answer engines. Quantum SEO principles help reveal relationships and signals that ordinary tools cannot detect. PSI forecasting allows executives to see what will happen in the next six to twelve months, not just what is happening right now. Automation agents continuously operate across the ecosystem, adjusting content, structure, and signals without waiting for human intervention.

None of this resembles an SEO agency. It is the work of a cognitive web engineering firm that treats visibility as an organizational asset, not a marketing checkbox.

Executive-Level Outcomes at the Center

When a company invests in ThatWare, the results do not show up as vanity metrics. They show up in ways the executive team can quantify and defend.

Pipeline grows because the brand appears in the questions buyers ask during early research. Revenue increases because the company becomes the reference point in AI summaries and expert answer feeds. Superiority in answer engines translates into category leadership. It shapes perception. It influences how buyers shortlist vendors. It reduces reliance on paid media. It gives Sales and Product teams intelligence they could not access otherwise. The compounding effect is powerful enough that organizations treat it as a strategic moat.

This is what modern executives expect. Not keyword wins, not traffic charts, not backlink reports. They want a partner who can shape how their brand appears across the expanding digital reality that AI systems create. Traditional SEO agencies were never built for this world. ThatWare was.

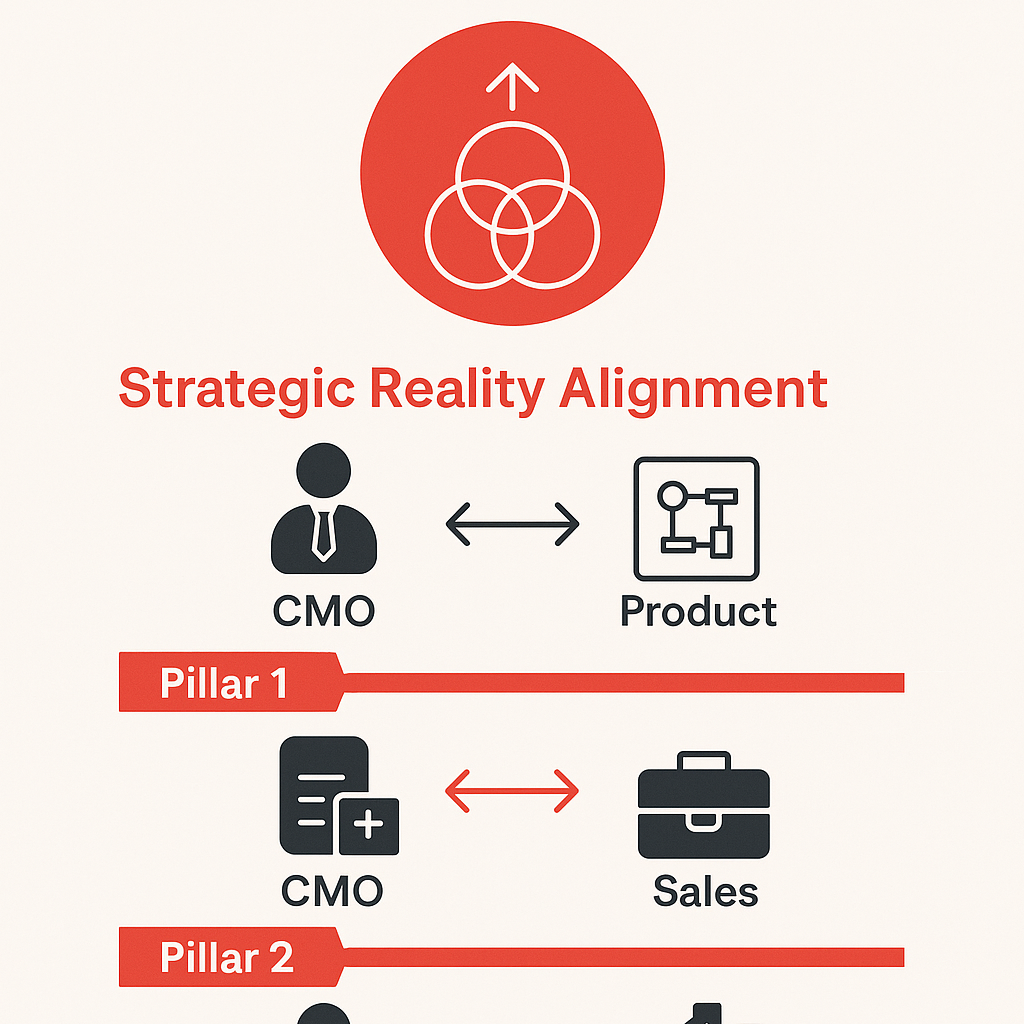

Introducing the Unified Growth Planning Model

Modern CMOs operate in an environment where markets shift faster than internal teams can react. Sales works its own playbook. Product builds from its own assumptions. Finance asks for predictable returns without seeing the full demand picture. The result is a familiar pattern. Every department runs hard, but often in different directions.

The Unified Growth Planning Model changes this by giving CMOs a method to align Sales, Product and Finance around a single version of market reality. Instead of arguing about priorities and budgets, everyone can see the same information and the same risks. When this happens, alignment becomes much easier, and growth becomes far more predictable.

This model rests on three pillars. Each one brings a different department closer to Marketing, not through meetings and memos, but through shared intelligence and shared incentives.

**Pillar 1: Strategic Reality Alignment

(CMO working with Product)**

Many organizations say they are customer focused, yet their internal decisions still rely on old assumptions. Product teams often define features based on what they believe users want. Marketing builds messaging based on what competitors appear to be doing. Neither side sees the complete landscape.

Strategic Reality Alignment gives both teams an accurate, shared view of the market using KGX. KGX works like a living map of the industry. It identifies the entities, relationships, questions and intent patterns that shape real customer demand. What emerges is a clear visual of how the market actually behaves, not how internal teams imagine it behaves.

1. Shared Market Reality

Creating a shared source of truth begins with KGX. It organizes the entire ecosystem. This includes direct competitors, indirect competitors, emerging players, and all the intent clusters that influence buying decisions. Once this structure is in place, everyone can look at the same insights instead of debating interpretations.

For Product teams, this is powerful. They no longer rely solely on qualitative research or feature requests. They can see which problems carry the most commercial weight. They can see which topics appear frequently in AI answers. They can also identify where users struggle and what specific needs are still underserved.

2. Product Roadmap Alignment

Once both teams share the same map, they can start shaping the product roadmap with more confidence. Key questions become much easier to answer.

Which features are truly aligned with market demand? Which areas show growth in search and AI generated answers but are currently underdeveloped by competitors? Are there gaps where user interest is high but no one offers a strong solution?

These answers help Product avoid missteps. They can also see which product categories suffer from limited visibility in AI engines. If AI models are skipping the brand or misrepresenting the offering, this becomes an immediate priority.

Roadmaps then shift from reactive feature development to proactive category creation. This move alone can reposition a brand and open new revenue lines.

3. Strategic Outputs for CMOs

When CMOs and Product work from the same market intelligence, several strategic advantages appear.

First, category creation becomes possible. KGX often reveals areas where no competitor has claimed a dominant narrative. CMOs can move fast and define the language, positioning and story before anyone else.

Second, messaging becomes clearer. Instead of guessing which phrases or angles resonate, CMOs build a messaging hierarchy grounded in actual user behavior. This removes friction between departments and allows Marketing to produce content that Product will endorse without hesitation.

Finally, the content strategy becomes sharper. Writers and strategists know exactly which intents to target and which themes reflect true market patterns. This creates content that performs better, ranks faster and influences both human readers and AI systems.

**Pillar 2: Revenue Alignment

(CMO working with Sales)**

For most organizations, Marketing and Sales alignment has always been a challenge. Marketing teams celebrate traffic or brand engagement. Sales teams focus on pipeline and deals. When both sides use different scoreboards, friction is inevitable.

Revenue Alignment solves this by grounding both teams in the same economic intent clusters. Instead of talking about traffic or impressions, both teams talk about the actual signals that lead to revenue.

1. Replace Traffic Goals with Economic Intent Clusters

Economic intent clusters reveal the topics, questions and signals that historically lead to revenue. A user searching for a specific pain point or a pricing related question has far more commercial potential than a user looking for informational advice.

Once these clusters are mapped, Marketing stops optimizing for vanity metrics. Campaigns are prioritized based on money intents. Sales benefits from this shift because leads coming through these clusters tend to have stronger qualification potential.

This also eliminates the long-standing argument about lead quality. Both teams work from the same intent dataset, so expectations and outcomes align naturally.

2. PSI Forecasting Informs Sales

Predictive SERP Intelligence adds another layer of insight. PSI forecasts how market demand will shift over the next six to twelve months. It shows which competitors are gaining momentum, which queries are losing relevance and which emerging patterns could create sudden spikes in demand.

Sales teams can use this information to prepare far in advance. They know which territories will heat up. They know which competitor narratives will create objections. They can identify where a takeover threat exists and adjust their talk tracks accordingly.

This kind of forecasting removes surprises and brings predictability to the revenue engine.

3. Joint GTM Execution Framework

Once the intelligence is shared, Marketing and Sales can work as a unified unit. KGX equips Sales with battlecards that explain competitor positioning, customer pain points and semantic advantages. Marketing uses the same information to produce GEO ready content that supports these sales conversations.

Instead of running separate campaigns, both teams push in the same direction. Shared KPIs reinforce this alignment. SQLs become the bridge metric. Pipeline influenced and revenue influenced capture the long term effect of organic and AI driven visibility.

This joint framework removes the silos that usually slow down GTM momentum and creates an engine that scales with far fewer meetings and far fewer missed handoffs.

**Pillar 3: Financial Alignment

(CMO working with Finance)**

Many CMOs struggle to justify their budgets because Finance often sees marketing as an unpredictable cost center. Reality Optimization changes this perception. It offers Finance the clarity they need to understand where revenue opportunities exist and how Marketing contributes to them.

1. Give Finance Predictability

Finance leaders want consistency, reliable forecasting and clear ROI. When Marketing can tie organic influence directly to pipeline and revenue, the conversation shifts. Instead of asking for more budget to create content or run campaigns, CMOs show how economic intent coverage reduces CAC, strengthens influence on conversions and stabilizes inbound demand.

Connecting PSI forecasts to budget planning gives Finance a view into future market dynamics. They can see where demand will rise or fall and allocate resources accordingly.

2. Reality Audit Becomes a Board Level Financial Document

The Reality Audit does much more than evaluate SEO or search performance. It gives executives a full picture of risk and opportunity.

This includes the following:

- The revenue windows the company is missing.

- Emerging competitor threats.

- Blind spots in AI generated results.

- Projected revenue gains from strengthening entity visibility and category positioning.

Boards appreciate this format because it strips away marketing jargon. They see risk, market dynamics and ROI projections in clear, financial language.

3. Budget Protection for CMOs

When Finance understands how market demand is shifting and where the brand stands in AI answers, they rarely cut budgets. Risk forecasting shifts the conversation. Instead of challenging the spend, Finance begins asking what more can be invested to secure future growth and reduce dependency on paid acquisition.

This strengthens the CMO’s position, turning the marketing budget into a strategic asset instead of an expense.

The ThatWare Framework: The Only Model Built for C-Suite Alignment

When a CMO speaks about “alignment,” it often sounds theoretical. Leaders talk about getting Sales, Product, and Finance to rally around a shared growth plan, but in practice, every department sees a different picture of the market. Marketing looks at channel data. Sales looks at pipeline health and objections. Product looks at feature gaps. Finance looks at budgets, CAC, and profit margins. These perspectives rarely line up.

ThatWare’s framework was built to solve this problem at the root. Instead of trying to force alignment through meetings or internal playbooks, the system creates a single version of reality that every department can finally agree on. The process unfolds across three clear phases. Each phase has a specific purpose, specific outputs, and specific executive-level outcomes. When all three are executed in sequence, the organization gains a complete “growth operating system” that connects customer reality, market movement, and revenue priorities.

Below is a breakdown of how the framework works, why it matters to senior leadership, and how it transforms a fragmented organization into a coordinated growth engine.

Phase 1: Reality Audit and Strategic Blueprint (Months 1 to 2)

Phase 1 is where companies see, often for the first time, the actual shape of their digital and competitive reality. Many CMOs assume they understand how their brand appears across search, AI systems, and competitive categories, but the Reality Audit often reveals blind spots.

1. KGX Initial Build

KGX is ThatWare’s knowledge graph infrastructure. It captures the entire digital ecosystem of the brand along with competitors, entities, products, intent clusters, and category signals. Instead of looking at keywords, KGX maps how your industry is connected. It is the closest thing to a living blueprint of your online presence.

Why this matters for the C Suite:

KGX becomes a shared source of truth. Sales sees demand patterns that match their conversations. Product sees what customers actually associate with the category. Finance sees how market share maps across entities and themes. Nothing is based on guesswork anymore.

2. GEO and PromptRank Audit

GEO examines how visible the brand is in AI generated answers. PromptRank tracks your position within key AI responses across engines like Gemini, ChatGPT, and Perplexity. Both reveal a new kind of vulnerability. Brands lose influence not because they rank poorly but because AI systems do not reference them at all.

Why this matters:

This audit shows what percentage of AI answers the brand controls and where competitors dominate. It becomes impossible for any department to ignore the risk because it is presented plainly and quantitatively.

3. PSI Baseline and Market Forecast

PSI, or Predictive SERP Intelligence, reveals where the market is shifting. Instead of reacting to trends, CMOs receive a forecast of what will happen in the next six to twelve months.

Impact on alignment:

Sales can prepare for upcoming demand pockets. Product can prioritize features tied to future interest. Finance can allocate budgets based on predictable revenue windows.

4. Executive Grade Board Report

The audit phase concludes with a board level report that outlines risks, gains, opportunities, and projected growth trajectories. This is not a technical SEO report. It is a strategic document written for decision makers.

What executives gain:

A clear understanding of the brand’s current position, the competitive landscape, and the financial stakes. Everyone agrees on the same starting point which immediately removes cross-department misalignment.

Phase 2: Architecture and Implementation (Months 3 to 8)

Once the organization has clarity on its environment, ThatWare moves into the build phase. This is where the company’s digital infrastructure is reshaped so the market sees the brand the way the business wants to be seen.

1. Expansion of KGX and Entity Architecture

The knowledge graph built in Phase 1 becomes deeper and more detailed. Missing entities are added. New relationships are mapped. Product categories are structured in ways that search engines and AI systems can interpret accurately.

Why this matters:

A brand’s digital future depends on how well machines understand its identity. This structure guides all other departments. Sales benefits from precise messaging. Product teams understand how the market interprets features. Marketing gains solid footing for content and communication.

2. Deployment of Hyper Intelligence Automation Agents

These agents continually optimize parts of the company’s digital environment. They monitor changes, rewrite signals, restructure content clusters, and automate essential tasks that would normally require multiple teams.

Executive benefit:

This removes operational bottlenecks. Marketing teams are not bogged down by manual work. Changes happen quickly. Performance improves without heavy internal labor.

3. GEO Activation Across the Ecosystem

Instead of simply publishing content, ThatWare activates structured signals across websites, content hubs, product pages, and public digital assets. AI engines begin recognizing the brand as an authority.

Why this matters:

Competitors who dominate AI answers often do so because they were early. GEO activation moves a brand into those conversations, increasing visibility where buying decisions now begin.

4. NCN Content Hubs

NCN, or Neural Content Networks, form clusters of self improving content. These hubs learn, adapt, and update themselves. They strengthen category presence and improve entity relationships, which helps both search engines and AI systems understand the brand more clearly.

Pipeline impact:

This raises visibility for commercial intent clusters. Sales receives more qualified inbound interest. Marketing gains stable and compounding organic growth.

5. Outputs of Phase 2

By the end of this phase, CMOs receive:

- A unified messaging architecture

- Product market alignment charts

- Revenue targeted content frameworks

- Competitive positioning improvements

- Stronger presence in AI answers

- A stable automation driven optimization system

The company now has digital infrastructure that mirrors its strategic goals. This is the point where alignment begins to feel natural because every department is drawing from the same intelligence layer.

Phase 3: Domination and Institutionalization (Months 9 to 12)

Phase 3 secures the gains from earlier phases and embeds them into the everyday operating rhythm of the organization. This is where the transformation becomes permanent.

1. Continuous Optimization

ThatWare’s agents continue improving entity relationships, content structures, and AI visibility. Instead of waiting for quarterly results or reacting to downturns, optimization happens continuously.

Why this matters:

Markets shift. Competitors release new content. AI engines change behavior. Continuous optimization protects the brand’s position and ensures consistent dominance.

2. Executive Dashboards

Dashboards are built specifically for senior leadership. They highlight the metrics that matter most to CMOs, CROs, and CFOs. Instead of pages of analytics, leaders see:

- Revenue influence

- Pipeline impact

- AI visibility share

- Category dominance

- Forecast shifts

Impact:

Executives stop debating data because everyone sees the same numbers.

3. Quarterly Cognitive Web Reviews

These reviews mirror what you would expect from a McKinsey or Big Four consulting engagement. They cover:

- Competitive movement

- Market changes

- Risk zones

- Opportunity clusters

- Forecast updates

- Product feature recommendations

- SEO and AI ecosystem trends

Why this is valuable:

It gives the C Suite a recurring strategic checkpoint rooted in intelligence, not opinion.

4. Internal Enablement and Knowledge Transfer

Teams across Marketing, Sales, Product, and Finance are trained on Reality Optimization principles so they can make informed decisions independently.

Examples include:

- How Sales can use AI answer intelligence in outreach

- How Product can build feature narratives tied to intent clusters

- How Finance can anticipate budget shifts using PSI patterns

This turns ThatWare’s system into an organizational capability rather than an external dependency.

5. Institutional Adoption Across the Company

By the end of Phase 3, the business has a shared language. Sales, Product, and Finance use the same intelligence layer, interpret the same market signals, and understand the same forecasts.

Alignment becomes tangible because:

Sales messaging reflects the same entity architecture Product uses

Product roadmap decisions follow market intent mapping

Finance budgets based on predictable revenue influence

Marketing drives category presence backed by KGX and GEO intelligence

All departments finally agree on what the market wants, how the brand should appear, and where the growth is coming from.

Step-by-Step Guide: How CMOs Close High-Ticket Digital Transformation Deals Internally

Winning internal approval for a digital transformation initiative is no small task. Most CMOs know the value of long-term organic strength, structured intelligence, and a modern approach to search. The real challenge is helping the CEO, CFO, and other stakeholders understand the urgency and the upside in a way that moves them toward a confident yes.

What follows is a practical guide for CMOs who need to walk their organization through a high-ticket program such as Reality Optimization. It focuses on clarity, business impact, and a level of communication that resonates with the people who control budgets and strategy.

Start by Presenting “Reality Risk,” Not Marketing Data

Most executives have seen SEO reports filled with keyword rankings, impressions, and traffic charts. These reports rarely influence anyone outside the marketing department. To secure support, CMOs need to reframe the entire conversation around something much more pressing: market reality.

The idea is simple. Your brand does not live on your website anymore. It lives in the answers produced by large AI systems and search ecosystems. That reality can shift without warning, and the cost of being absent is real revenue loss.

A strong way to open the discussion is by sharing three specific risk signals:

PSI Forecasts

Predictive SERP Intelligence gives a glimpse into how visibility might change over the next quarter or year. When the leadership sees that certain competitors are projected to dominate high-value intent clusters, the conversation changes quickly. This kind of forecast introduces risk in a form the CEO and CFO understand: a future that harms revenue if left unaddressed.

Competitor Threats Inside Search and AI Ecosystems

Show them the gaps where rival brands already appear as the “default choice” in search results or AI answers. This is often the moment when executives realize they are losing influence even without a direct confrontation. Competitors who occupy the informational space become the first point of trust for customers, long before sales teams ever make contact.

Missing or Weak Representation in AI Answers

Today’s buyers rely heavily on systems like ChatGPT, Gemini, and Perplexity when seeking guidance. If these systems rarely mention your brand for commercially important questions, you are invisible where demand actually forms. When you present that absence as a lost opportunity, leadership sees the need for structural changes, not cosmetic improvements.

The goal is not to scare. The goal is to make the reality visible enough that the leadership team feels the urgency to act. Once risk is clear, the rest of the conversation becomes smoother.

Map Out the Alignment Path Inside the Organization

Digital transformation fails when marketing tries to carry the entire weight alone. To win internal buy-in, CMOs must demonstrate how other departments benefit, and more importantly, how they cannot achieve their goals without this shift.

Here is how to make that alignment visible:

Sales Gains Access to Intent Intelligence

Sales teams thrive when they understand what buyers want, how they ask questions, and where their interests are trending. By giving them intent clusters, demand patterns, and conversational signals derived from KGX and PSI, they can shape better outreach and adopt a more informed talk track. This elevates their ability to close deals and reduces wasted cycles.

Product Receives Clear Entity Maps

Product leaders often make decisions based on internal assumptions or limited user feedback. Entity mapping changes that. It reveals how the market perceives concepts, pain points, and category terminology. This helps the product team prioritize features, clarify positioning, and build around demand patterns instead of gut instinct.

Finance Gets a Predictable ROI Path

A CFO rarely approves budgets based on creative narratives. They want numbers they can trust and a forecast they can justify to the board. By tying Reality Optimization outputs to measurable shifts in pipeline influence, category visibility, and reduced paid reliance, the CMO gives Finance a model they can believe in. A predictable ROI story creates confidence, and confidence unlocks budget.

By showing how each department benefits, the CMO shifts the project from a marketing initiative to a company-wide investment that protects revenue and accelerates growth.

Introduce the 12-Month Roadmap Using ThatWare’s Blueprint

Executives respond best to structured, staged plans. A vague vision will always lose to a clear roadmap. This is where the CMO should introduce the three-phase Reality Optimization program in a simple, strategic way.

Start by outlining the progression:

Risk Phase: Understanding the Current Reality

Months 1 and 2 focus on diagnostics. The leadership sees the KGX foundation, the forecast from PSI, and a top-level view of the brand’s current position. This phase is straightforward because it creates a baseline that removes guesswork.

Transformation Phase: Reshaping the Digital and AI Presence

Months 3 through 8 involve the construction and deployment of entity structures, automation agents, content adaptation, and AI-engine inclusion. This is where the brand starts shaping its authority and presence. Executives need to see this phase as the moment when the company shifts from reacting to leading.

Domination Phase: Institutionalizing the Gains

Months 9 through 12 are about optimization and making Reality Optimization part of the organization’s ongoing strategy. The dashboards, quarterly reviews, and internal training ensure that the improvements do not fade. This phase proves long-term value.

Framing the roadmap as a journey from risk to transformation to dominance helps executives visualize the payoff. They no longer see this as a marketing project but as a strategic evolution.

Tie the Budget Request Directly to Pipeline Influence

When the conversation reaches budget approval, the most effective message is this:

This is not marketing spend. This is the cost of owning your category.

Executives respond instinctively to anything that protects revenue, improves predictability, and reduces dependency on paid channels. If the CMO can connect the investment to measurable pipeline impact, the budget decision becomes easier.

Make this connection clear through:

- The volume of commercial intents that influence revenue

- The projected uplift in qualified demand

- The share of voice in AI answers that shape early consideration

- The reduction in reliance on paid traffic over time

- The competitive risk of not establishing category presence now

When the budget is positioned as a growth multiplier rather than an expense, it becomes a strategic decision, not a marketing request. The CFO is more likely to approve funding when they see a clear path to increased pipeline influence.

The Trust Stack: How ThatWare Builds Enterprise Confidence

Enterprise buyers rarely make decisions based on features. Senior leaders look for something far more important: the confidence that a partner will protect their brand, support their internal teams, and deliver real financial outcomes. When a CMO or VP Growth evaluates a potential partner, the decision almost always comes down to trust. The deal moves forward only when the buyer is convinced that the partner understands the risks, carries a proven track record, and brings the kind of structure that fits an enterprise environment.

This is the point where most agencies fall short. They speak in tactics and technical jargon, but they fail to show evidence that resonates in a boardroom. ThatWare takes a very different path. Over the years, the company has invested heavily in creating what we call a Trust Stack. This is a layered set of proof points that help senior leaders feel safe, informed, and supported. Each layer has a purpose. Each one answers a specific question that enterprise buyers often hold back but never stop thinking about.

External Proof

The first layer is the simplest one, but it carries weight. External proof is not about bragging rights. It is about showing that independent institutions have already validated the work.

Awards: Recognition from respected organizations signals that the approach behind ThatWare is not experimental. It shows that the industry acknowledges the company’s strengths and contributions.

Government copyrights: These matter more than most people realize. They show that the frameworks, systems, and intellectual property behind the service offering are original and legally recognized. For enterprise buyers, this suggests maturity and long term stability.

Features in publications like Forbes: Coverage in credible media outlets helps senior leaders feel comfortable. Executives prefer partners who are already known and trusted beyond their own industry circle.

Clutch ratings: When other high value clients publicly vouch for a company, it sends a clear message. Real businesses with real stakes have seen real outcomes.

Proprietary concepts such as Reality Optimization, PromptRank and ThatVerse: These are not buzzwords. They reflect a depth of research, invention and engineering that goes far beyond traditional SEO. Enterprise buyers look for originality because it means they are not purchasing recycled tactics. They want to know that they are working with a company that can help them compete in a landscape that keeps changing.

This layer answers the first question in every buyer’s mind: Can I trust this company’s expertise?

Case Studies With Executable Outcomes

The second layer of the Trust Stack deals with proof of performance. Awards are useful, but enterprise buyers want specifics. They want to see results that look like their own goals. They want to know what the work actually accomplished and whether those outcomes could be repeated in their environment.

ThatWare presents case studies built around metrics that matter to a CMO or CFO.

Organic revenue growth: Senior leaders care about revenue, not traffic. Showing how ThatWare’s programs have increased revenue influenced by organic channels proves that the work affects business outcomes, not vanity metrics.

AI answer share: This is a new area of competitive advantage that most companies do not even realize they are losing. Demonstrating measurable increases in brand visibility inside AI generated answers is a powerful indicator of category strength and future pipeline reliability.

Reduction in dependency on paid channels: When organic systems become more intelligent, companies can gradually reduce their reliance on expensive paid media. For finance teams, this represents long term cost stability.

Category dominance: This is where the larger story comes together. Case studies should show how ThatWare helped brands move from being one of many options to becoming the natural authority in AI answers, search ecosystems and company specific knowledge graphs.

This layer answers the second question every buyer secretly holds: Can this partner produce outcomes that justify a high ticket investment?

Executive Level Collateral

The final layer in the Trust Stack focuses on how ThatWare communicates and delivers its work. Enterprise buyers want a partner who operates in a way that fits their internal culture. They look for clarity, structure, data accuracy and a style of reporting that aligns with executive expectations.

Board-ready decks: These are clean, simple and built for senior decision makers. They focus on risks, opportunities and financial outcomes. They help CMOs communicate the value of Reality Optimization in a language that their CEOs and CFOs understand.

Executive briefing books: These provide a reference guide for leadership teams. They explain the findings of the Reality Audit, the strategic roadmap and the projected impact in a format that is easy to share throughout the organization.

Cognitive Intelligence dashboards: These visual dashboards allow executives to track progress without reviewing technical details. They focus on the metrics that matter: pipeline influence, answer dominance, competitive threats, and projected gains.

This layer addresses the final question in a buyer’s mind: Will this partner make my job easier and support my team in a professional, structured way?

Go-To-Market: How ThatWare Attracts and Closes High-Ticket Clients

Winning a high-ticket client in today’s environment is no longer about having a good pitch. Large companies have already heard every pitch imaginable. They have been approached by dozens of agencies promising quick wins and magical dashboards. What they respond to today is a different level of thinking. They want partners who bring original intelligence, who can see around corners and who can show a clear path from market presence to revenue outcomes.

ThatWare’s approach to winning high-ticket clients is built on this philosophy. It is not driven by traditional outreach or the same marketing playbook that every other SEO shop follows. Instead, it relies on a combination of targeted intelligence, high-touch insight sharing and partnerships with groups that already influence the biggest marketing budgets in the industry.

The following Go-To-Market framework connects directly with what enterprise buyers look for: foresight, credibility and a sense of strategic safety. For CMOs, CROs, product leaders and finance heads, this is the type of engagement that feels natural because it mirrors the consultative flow of major transformation programs.

Hyper-Targeted ABM for Enterprise Clients

Account Based Marketing for high-ticket buyers requires a level of preparation that most agencies never bother to do. ThatWare treats ABM as a research discipline rather than a sales tactic. The goal is not to spray outreach messages and hope that someone books a call. The goal is to show decision makers something they did not know about their own digital reality and to reveal the risks and opportunities shaping their industry.

1. Building a List of 100 to 200 Dream Accounts

The process begins with a carefully selected list of companies that match ThatWare’s sweet spot. These are organizations with complex product lines, competitive markets and high dependency on organic demand. They are usually mid market and enterprise brands across technology, finance, healthcare, manufacturing and fast growing consumer categories.

Each account is reviewed manually. The team evaluates their market footprint, how crowded their category is and whether their search and AI visibility aligns with their size. The intention is to prioritize brands with the most to gain from Reality Optimization and with the biggest risk of losing visibility as AI engines replace traditional search behavior.

2. Creating Mini Reality Snapshots Internally

Before anyone from ThatWare reaches out, the team prepares a small internal audit for each target brand. These mini Reality Snapshots reveal:

• How the brand appears inside major AI answer engines

• Which competitors dominate high-value intent clusters

• Where the brand’s knowledge graph is broken or incomplete

• What the pipeline impact could be if the company’s visibility weakens further

• Blind spots in SERPs that the brand has never addressed

These are not full audits. They are short, sharp intelligence briefs that help the outreach team understand the account’s situation with more depth than the company’s own marketing department often has.

Executives can sense when an agency has genuinely studied their business rather than making assumptions. The snapshot becomes proof that ThatWare has thought about the brand before ever asking for a meeting.

3. Crafting Personalized CMO Outreach

Once the intelligence is ready, outreach is written for the CMO or VP of Growth. The tone avoids the usual sales fluff and speaks directly to what senior executives actually care about:

- Revenue risk

- Category leadership

- Competitive threats

- Buyer perception in AI environments

- Forecastable growth

A sample outreach message might look like this:

“We’ve been mapping how AI engines are shaping the customer journey in your industry. Your competitors are showing up as the preferred answers for several of the most commercially important queries. I created a short snapshot that shows where your brand is missing and what this shift could mean for your revenue mix. If a quick walkthrough is useful, I can share it in a brief 15 minute call.”

Short, direct, specific. No hype.

4. Offering a 15 Minute Executive Intelligence Briefing

The goal of the first meeting is not to sell anything. It is simply to show the Reality Snapshot and to clarify the truth behind it. Executives appreciate concise calls that respect their time. In these 15 minutes, they see:

- The difference between traditional SEO and Reality Optimization

- How their competitors are positioning themselves in AI ecosystems

- Which content or product categories are at risk of losing visibility

- What the next 12 months look like under current market conditions

The meeting works because it changes the conversation immediately. Instead of talking about rankings or keywords, the team talks about risk modeling, competitive intelligence and category visibility. That language resonates with CMOs and CFOs who think in revenue cycles, not technical tasks.

5. Moving Through the Funnel Toward a Reality Audit

The purpose of the briefing is to earn the right to offer the next step. If the executive finds the insights meaningful, the call naturally leads into one of two outcomes:

- A paid Reality Audit designed to create a complete cognitive map of their entire digital reality

- A high-value audit provided free of charge for top tier accounts that fit perfectly into ThatWare’s ideal client profile

The flow then moves through a structured sequence:

Reality Audit

The brand receives a detailed ecosystem map, knowledge graph review, AI answer engine presence, competitor analysis and predictive forecast.

Strategy Workshop

The leadership team meets with ThatWare to co-create the transformation roadmap.

Proposal

The proposal presents only high-end transformation options that match enterprise expectations.

This is how ABM becomes a predictable source of high-ticket clients. It is not based on persuasion. It is based on insight that executives cannot ignore.

Thought Leadership Engine for C-Level Audiences

C-level executives rarely search for SEO services. They look for frameworks, predictions, market intelligence and strategic viewpoints. They consume content that helps them make decisions about the future, not tutorials on optimization.

ThatWare has built a thought leadership engine around topics that matter to CMOs, CROs and CFOs who are preparing for a shift in search behavior. This is where the brand creates authority and recognition long before a sales conversation begins.

Topics That Capture Executive Attention

A CMO does not want surface-level marketing advice. They want the truth about what will affect their pipeline. Topics that consistently resonate include:

- How artificial intelligence will quietly divert a large portion of organic revenue away from brands

- Why most SEO programs will fail to adapt to the Cognitive Web

- How finance departments should evaluate organic investments in AI driven markets

- Why category dominance in AI answers will determine the next wave of winners and losers

These ideas establish ThatWare not as an SEO supplier but as a strategic partner that shapes digital reality.

Channels That Create Visibility

To reach senior leaders, ThatWare publishes insights through the formats they trust.

Keynotes

Speaking at SaaS summits, marketing forums and innovation events gives executives a sense that ThatWare operates at a strategic level. Keynotes help position the company in the same mental category as major consulting firms.

Webinars

Live webinars allow CMOs to see Reality Optimization in action. The team walks through real examples, competitive landscapes and AI ecosystem shifts.

Podcasts

Executives spend hours on podcasts during travel and at the gym. Sharing thoughtful breakdowns of industry changes increases brand trust.

LinkedIn Leadership

LinkedIn remains the most powerful platform for connecting with VPs and CMOs. Thoughtful posts, data-based insights and provocative narratives build authority.

Industry Partnerships

Appearing in sessions hosted by venture communities, SaaS founders and tech associations signals that the brand is trusted by innovation leaders.

The aim is to speak in a language that executives already use. By the time a decision maker approaches ThatWare, they already understand the value because they have absorbed months of insight.

Strategic Partner Ecosystem

While direct outreach and thought leadership generate strong demand, some of the highest ticket opportunities begin through partnerships. Large brands rarely make decisions alone. They depend on the guidance of development agencies, creative firms, financial groups and consultants.

These partners hold influence. They help shape strategy, procurement decisions and vendor selection. ThatWare treats these firms as a core part of its growth model.

1. Relationships With Development and Branding Agencies

Big digital agencies often control multi-million dollar website builds and brand refresh projects. Their clients rely on them for guidance on search, AI readiness and content architecture, but most agencies lack expertise in Reality Optimization and search intelligence.

ThatWare becomes the specialized lab that agencies bring into their projects. The agency provides creative and development muscle while ThatWare handles knowledge graph architecture, entity strategy and cognitive SEO. It is a natural collaboration because both sides benefit.

2. PE and VC Networks

Private equity and venture groups are always looking for ways to improve the performance of their portfolio companies. Organic visibility, category leadership and revenue diversification matter more than ever.

When ThatWare helps a single portfolio company achieve better AI visibility or a stronger knowledge graph infrastructure, the entire network takes notice. This often leads to introductions across 10 or 20 other companies, many of which are perfect high-ticket fits.

3. Consulting Firms

Management consultancies and digital transformation firms regularly work with clients who are undergoing major changes. They often need specialized SEO or AI-driven expertise. ThatWare fills that gap. Consultants trust partners who can deliver something unique and who can explain it in simple terms during boardroom discussions.

4. Referral Engines and Acquisition Partners

Over time, a high-performing service model creates a steady flow of referrals from clients, CDPs, analytics partners and tech vendors. These introductions often skip the early stages of typical sales cycles because trust is already built.

How ThatWare Becomes the Specialized Lab

ThatWare’s role in these partnerships is similar to a research and strategy lab. Instead of providing commodity SEO tasks, the team brings:

- Market intelligence

- Cognitive Web architecture

- Predictive models

- Reality Optimization methodologies

- Knowledge graph engineering

- Data-driven entity alignment

Partners rely on ThatWare for insights that go beyond their own capabilities. This makes the brand sticky, irreplaceable and positioned for continuous high-ticket deals.

What the Next 24 Months Look Like for CMOs

The next two years will likely reshape a CMO’s responsibilities more than the last decade combined. The old search-first customer journey is fading, replaced by interactions that begin inside AI answers, recommendation engines, and mixed reality environments. Consumers are no longer typing queries the way they once did. They are speaking, showing, tapping, asking, and expecting an immediate, authoritative answer. This change alone will force marketing leaders to rethink how their brands show up in the world and, more importantly, how those brands are interpreted by intelligent systems.

Traditional search will not disappear overnight, but its influence will shrink every month. It will feel gradual at first. Traffic patterns will begin to shift. Some of your top-of-funnel pages will lose visibility without explanation. You will notice customers discovering products through AI summaries instead of keyword rankings. The real shock comes when competitors who never outranked you in classic search begin appearing consistently in AI-driven responses. They may not have more content, but they have better entity structure and stronger representation in knowledge graphs. The companies that thrive in this environment will be the ones that understand how to shape their digital reality instead of simply reacting to it.

The interface customers use is already becoming multimodal. People ask questions with text, but also with images, voice, gestures, and context from their devices. AI tools interpret these signals together, which means the brand that wins is the one that teaches these systems how to understand its offering. This shift creates a new responsibility for CMOs. You are no longer only orchestrating campaigns. You are shaping the way machines perceive your business, your products, and your industry. This requires more precision, better data, and a level of semantic clarity most marketing organizations have never built before.

Reality Optimization will soon become a required discipline rather than a nice idea. Companies that treat it like an experiment will fall behind companies that treat it as core infrastructure. It is no longer enough to create content and hope algorithms find it. You will need a structured way to control how your brand is interpreted across the Cognitive Web. Knowledge graphs will play the same role that websites played in the early 2000s. They will become the backbone of digital identity. When they are weak or incomplete, AI models invent their own version of your brand. When they are strong, they project accuracy, authority, and trust across every channel.

The next wave of market leaders will not be defined by who owns the most backlinks or the most blog posts. They will be defined by who owns the most influential answers. As AI answers become the first stop in the buying journey, only a few brands will consistently appear for the questions that matter. These brands will feel magnetic. Customers will assume they are the category authorities because the systems they rely on repeatedly point to them. This is what category gravity looks like. It is subtle at first, but once established, it becomes incredibly difficult for competitors to reverse.

CMOs who embrace this shift early will build a long-term competitive advantage. They will be able to forecast market movement, project revenue impact from organic presence, and protect their position inside AI-driven ecosystems. Their organizations will be more aligned because Reality Optimization provides a single source of truth that connects Product, Sales, Finance, and Marketing. On the other hand, companies that remain siloed will lose market share quietly. They will not understand why their funnel is shrinking or why buyers are gravitating toward competitors who once seemed far behind.

This is where ThatWare becomes an essential partner. The Cognitive Web era demands more than SEO or content production. It requires a coordinated transformation of how your brand is represented in machine-readable form. ThatWare’s approach, built around deep knowledge graph engineering, predictive intelligence, and structured entity architecture, helps CMOs take control of their digital reality. The companies that recognize this early will be the ones shaping their markets, not reacting to them.

The next 24 months will belong to the leaders who act with clarity. Those who build the right infrastructure now will own the answers customers rely on later. That is the true battleground for growth, trust, and category dominance.

Request Your Reality Audit

If your organization is preparing for its next stage of growth, this is the moment to look at the market with complete clarity. Most companies operate with outdated assumptions about how customers discover, compare, and trust brands. A Reality Audit gives your leadership team a clear view of what is actually shaping demand in search, AI answers, and the broader digital ecosystem.

We only open a limited number of audit slots each quarter. This keeps the work hands-on, tailored, and worthy of executive attention. The outcome is not a stack of technical recommendations. You receive a board-level briefing, clear risk assessments, and a plan that shows exactly where your brand stands and how far it can move within the next year.

Senior leaders rely on certainty. The Reality Audit removes guesswork and replaces it with data that speaks to pipeline growth, competitive positioning, and financial impact. CMOs, VPs of Growth, and cross-functional executives consistently find that the audit helps them speak with one voice and make stronger decisions with confidence.

If you want to understand the real opportunities ahead and how your organization can become the center of gravity in your category, this is your starting point.

Request your Reality Audit and step into the future with a clear strategic path.